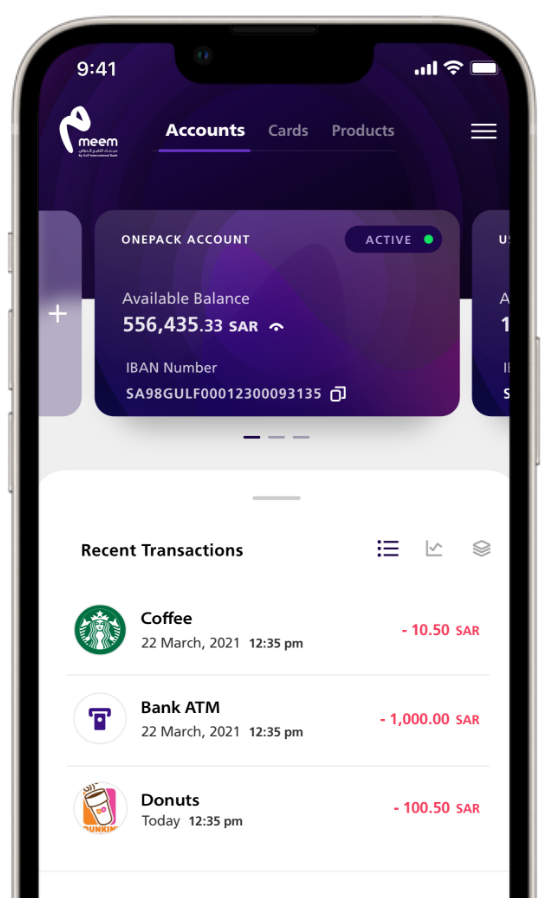

meem Multi-currency account forms part of the meem OnePack account providing you with instant access to three types of account on one debit card.

It is an ideal travel card for individuals who travel frequently, for those who need to transact in multiple currencies, bypassing the fees tied to currency conversion at the point of sale

![Mobile Web Size 430X740 En 100[51]](/media/vrel0rtp/mobile-web-size_430x740_en-100-51.jpg?anchor=center&mode=crop&width=430&height=740&rnd=133679505324930000)