- Shariah compliant financing programs based on the principles of Murabaha

- Quick and easy application process

- Flexible installment plans to suit your needs

- Competitive profit rates

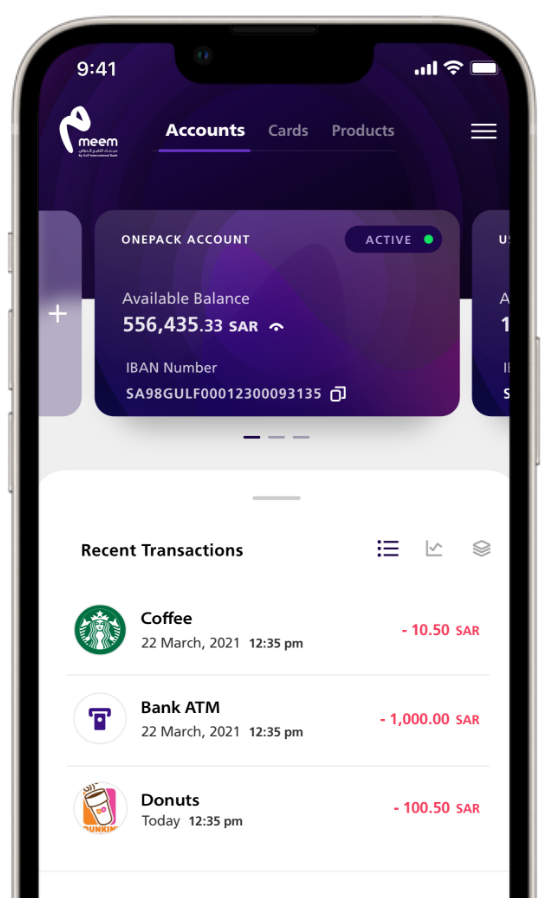

- Fully digital journey including E-title deed transfer

- Peace of mind with credit life cover in the event of death or permanent total disability ( God forbid)

- Finance amount up to SAR 5 million

- Annual Percentage Rate (APR) is starting from *4.68%

- Admin fees of 1% or SAR 5,000 whichever is less

- Credit counselling services are provided throughout the application process, to help you assess product risks and make an informed and effective decision

- Property insurance to protect from accidental damage/destruction of property

For more information call 8001166336